06 July

Making Tax Digital (MTD) in 2025: What It Means for Businesses, Sole Traders & Landlords

Making Tax Digital (MTD) is transforming how individuals and businesses in the UK manage their taxes. While many are already using MTD for VAT, the changes continue to roll out — and it’s crucial to know what’s happening now, what’s coming, and how to prepare.

In this blog, we break down everything you need to know about MTD in 2025 — whether you're a sole trader, landlord, or small business owner.

🧾 What is Making Tax Digital (MTD)?

MTD is a UK government initiative by HMRC designed to make tax administration more effective, efficient, and easier for taxpayers.

Instead of annual paper submissions, MTD requires taxpayers to:

Keep digital records of income and expenses.

Use HMRC-approved software to track finances.

Submit quarterly updates and an end-of-year final declaration online.

It’s all about reducing errors and simplifying the tax process — but it does mean a big change for how taxes are handled.

📍 Where Are We Now in 2025?

✅ MTD for VAT

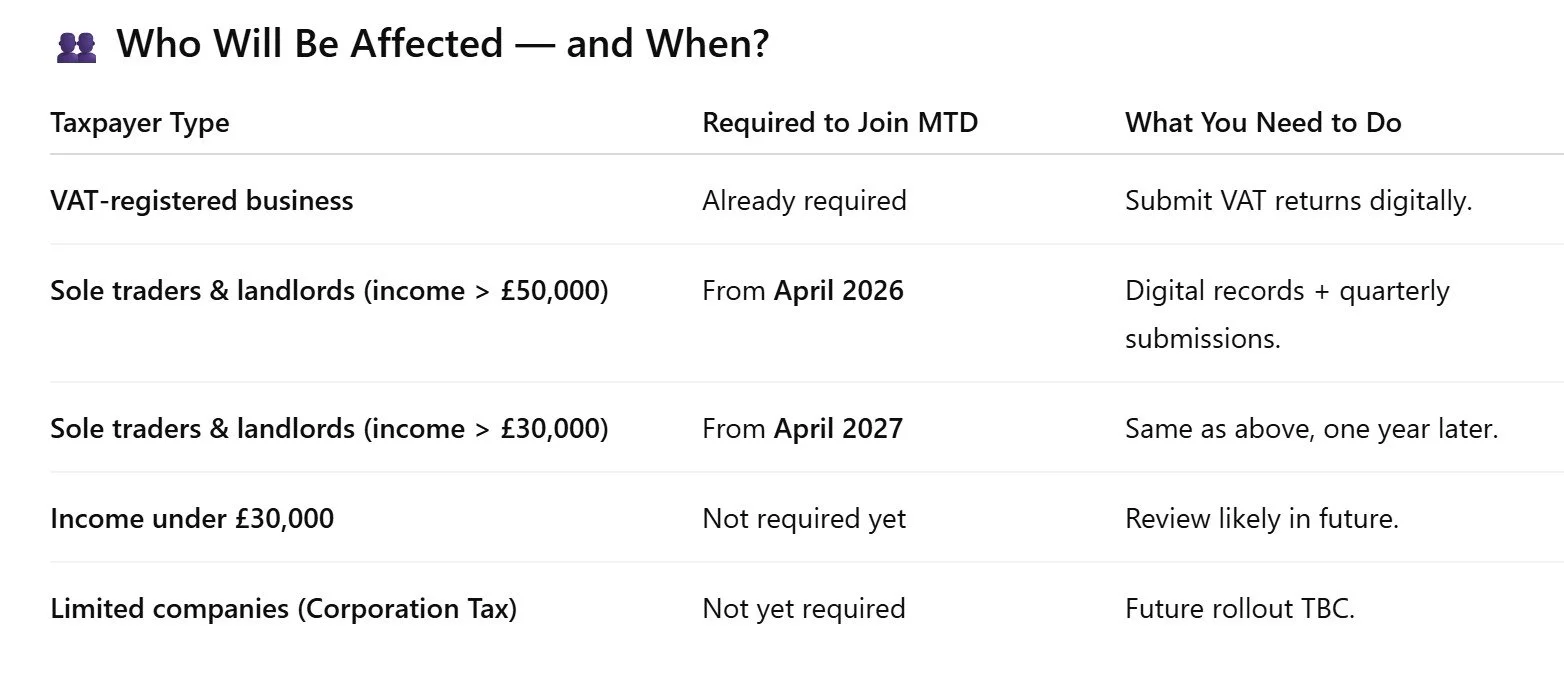

Live and mandatory for all VAT-registered businesses since April 2022, even those under the VAT threshold.

Businesses must keep digital records and file VAT returns through compatible software.

🔄 MTD for Income Tax (MTD ITSA)

Was originally due in 2024 but delayed. Now scheduled for:

April 2026 for sole traders and landlords with income over £50,000.

April 2027 for those earning between £30,000–£50,000.

Those earning below £30,000 are currently under review — no confirmed date yet.

🏢 MTD for Corporation Tax

Still in the consultation phase. Not expected to roll out until at least 2027 or later.

🧾 What Will Be Required?

If you're affected by MTD for Income Tax, here’s what you’ll need to do:

Keep Digital Records

No more shoeboxes of receipts. You must maintain accurate digital records using HMRC-recognised software.

Send Quarterly Updates

Every 3 months, submit a summary of your business income and expenses.

Submit End-of-Period Statements (EOPS)

At year-end, confirm your income and make any adjustments.

Final Declaration

This replaces the traditional Self Assessment return, including all finalised information.

🧰 How to Get Ready

Here are a few steps you can take now to stay ahead of the curve:

Check your income level to know your MTD start date.

Switch to MTD-compatible bookkeeping software like Xero, QuickBooks, or FreeAgent.

Digitise your receipts and expenses if you're still working with paper.

Seek professional support — a bookkeeper can make setup painless and ensure you're fully compliant.

❓ Common Questions

Can I still use spreadsheets?

Yes, but only if they’re connected to a digital tool (via bridging software) that allows submissions directly to HMRC.

Will I still need to do a Self Assessment tax return?

Under MTD for Income Tax, you’ll stop filing traditional Self Assessments. Instead, you'll submit quarterly updates and a final declaration online.

What happens if I don't comply?

HMRC will apply penalties for non-compliance, especially after the initial soft-landing period ends.

✅ Final Thoughts

MTD isn’t just a legal requirement — it’s an opportunity to modernise your finances, gain real-time insights, and reduce errors. But the key is preparation.

📞 Need Help Getting MTD-Ready?

At Wise Owl Accounting Services, we help sole traders, landlords, and small businesses transition to MTD with ease. Whether you need software advice, setup support, or ongoing bookkeeping, we’ve got you covered.

👉 Contact us today to stay compliant and stress-free!